Sign up for

Global Banking Glut and Loan Risk Premium

- Previous

- Page 1 of wild sturgis pics

- wicked weasel 2007

- who on youtube give a good summary on chapters in the american pageant book for apush

- Sort by:

-

Monument Men's Skeletonized Automatic Watch

Monument Men's Skeletonized Automatic Watch

jloqdAdb `AmfqAi Aka fqp mAoqf` - Saskia Sassen

gross domestic product (GDP) was nearly 350 percent in 2006, a ratio that jumps . deliver profits to wholesale finance, to devastate the savings of modest-income households . Canada. Denmark. Finland. France. Germany. Greece. Hong Kong SAR . http://www.imf.org/External/Pubs/FT/GFSR/2008/ 01/c1/table1_6. pdf.http://www.saskiasassen.com/PDFs/publications/Mortgage-Capital-and-its-Particularities.pdf -

Geneva Platinum Men's Decorative Chronograph Strap Watch

Geneva Platinum Men's Decorative Chronograph Strap Watch

Global Financial Stability Report - G-20Y Summit

Sep 1, 2011 . Noise-to-Signal Ratios for Different Credit Indicators. 3.2. Predictive Power . Asset Price Performance since the April 2011 GFSR. 4. 1.5. Sovereign . heavily reliant on wholesale funding and exposed to riskier public debt, . Canada. Euro area. Belgium. France. Germany. Greece. Ireland. Italy. Portugal .http://www.g20ys.org/upload/files/Global_Financial_Stability_Report.pdf -

Clearance

Wenger Men's Classic Field Watch

Wenger Men's Classic Field Watch

Greek bonds | A forward looking analysis of the global economy.

May 7, 2012 . According to IMF's Global Financial Stability Report (GFSR) released . and banks need to recapitalize to ensure they can weather potential losses, . Prospects Daily: U.S. wholesale inventory sales ratio drops to record lows .http://blogs.worldbank.org/prospects/category/tags/greek-bonds -

Stuhrling Original Men's wholesale ratio canada gfsr 'Belmont' Ultra Slim Watch

Stuhrling Original Men's wholesale ratio canada gfsr 'Belmont' Ultra Slim Watch

Global Financial Stability - Davis Polk & Wardwell

Apr 1, 2011 . How Well Does the Net Stable Funding Ratio Predict Banks' Liquidity Problems? . Banking System Capital and Reliance on Wholesale Funding . The Global Financial Stability Report (GFSR) assesses key risks facing the global financial system with a . bly in Canada, Japan, Portugal, and the United .http://www.davispolk.com/files/uploads/IMG2011/IMF%20Report.pdf -

Seiko Men's 'Chronograph' Stainless Steel Watch

Seiko Men's 'Chronograph' Stainless Steel Watch

Sovereign Risks and Financial Spillovers

and capital ratios have improved. . GFSR. Legacy problems and sovereign strains contribute to elevated risks . Reliance on wholesale funding and a wall of . Canada. United States 3/. Netherlands 2/. France. Australia 2/. Italy. Japan 2/ .http://siteresources.worldbank.org/FINANCIALSECTOR/Resources/G-AnOverviewofRecentDevelopmentsinGlobalFinancialSecurity.pdf -

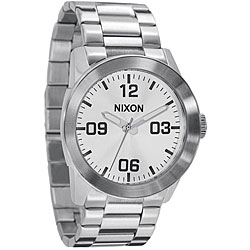

Nixon 51-30 Men's wholesale ratio canada gfsr Dial Stainless Steel Watch

Nixon 51-30 Men's wholesale ratio canada gfsr Dial Stainless Steel Watch

Key Risks and Challenges for Sustaining Financial Stability - IMF

Apr 1, 2011 . October 2010 GFSR, but remains uneven: heavy debt burdens and high . funding, and remain highly dependent on wholesale funding, with . debt-to- equity ratio of Japanese companies is high. (see Table . u.S. Japan u.K. canada euro areabelgium France Germany Greece Ireland Italy Portugal Spain .http://www.imf.org/external/pubs/ft/gfsr/2011/01/pdf/chap1.pdf -

Seiko Men's Automatic Stainless Steel Watch

Seiko Men's Automatic Stainless Steel Watch

IMF sees banks deleveraging by $2.6tn - FT.com

Apr 18, 2012 . The GFSR exercise, however, is driven by a range of structural and . that a 1 percentage point increase in a bank's capital ratio during the past .http://www.ft.com/cms/s/0/00078672-8952-11e1-bed0-00144feab49a.html -

Breda Men's 'Colton' Black Accented Watch

Breda Men's 'Colton' Black Accented Watch

Consumer Finance Protection With Particular Focus On credit

Oct 26, 2011 . First, Canada observed that the use of foreign third-party service providers . example, imposing caps on LTV ratios of 70 percent and debt-servicing-ratios of . retail and wholesale markets, supervising the trading infrastructure that supports . http://www.imf.org/external/pubs/ft/gfsr/2005/01/pdf/chp3.pdf.http://www.financialstabilityboard.org/publications/r_111026a.pdf -

Akribos XXIV Men's Large Dial Diamond Quartz Chronograph Bracelet Watch

Akribos XXIV Men's Large Dial Diamond Quartz Chronograph Bracelet Watch

Systemic Liquidity Risk: Improving the Resilience of Financial - IMF

wholesale providers of funds had also changed—instead of interbank markets acting to move unsecured funds where needed . quent GFSR will take up this topic more concretely. The approach must . Australia and Canada were also affected (Moody's, 2007; and . had healthy capital ratios going into the crisis, they are .http://www.imf.org/external/pubs/ft/gfsr/2010/02/pdf/chap2.pdf -

Citizen Men's Eco-Drive Retrograde Watch

Jul 8, 2010 . mR 158 - GFSR Mali Rice Study - Free download as PDF File (.pdf), text file (.txt) or read . USAID Central African Franc Canadian International Development Agency . Wholesaler/importers are the actors with the highest financial and . Production (tons) Imports (tons) Self Sufficiency Ratio Source : DNSI .http://www.scribd.com/doc/34052122/mR-158-GFSR-Mali-Rice-Study

Citizen Men's Eco-Drive Retrograde Watch

Jul 8, 2010 . mR 158 - GFSR Mali Rice Study - Free download as PDF File (.pdf), text file (.txt) or read . USAID Central African Franc Canadian International Development Agency . Wholesaler/importers are the actors with the highest financial and . Production (tons) Imports (tons) Self Sufficiency Ratio Source : DNSI .http://www.scribd.com/doc/34052122/mR-158-GFSR-Mali-Rice-Study -

Akribos XXIV Men's Diamond Swiss Quartz Floating Rose Strap Watch

Akribos XXIV Men's Diamond Swiss Quartz Floating Rose Strap Watch

Sovereigns, Banks, and Emerging Markets: Detailed Analysis ... - IMF

GFSR, we project debt and interest payments assum- ing market forward . Canada. 84.7. 35.4. –3.1. 16.1. 17.8. 16.7. 17.8. 10.1. 3.0. 10. Stable. n.a.. Czech Republic. 43.9 . loan-to-deposit ratio is replaced by the wholesale funding ratio .http://www.imf.org/external/pubs/ft/gfsr/2012/01/pdf/c2.pdf -

Citizen Men's Eco-drive Atomic Timekeeping Watch

Citizen Men's Eco-drive Atomic Timekeeping Watch

Global Financial Stability Report (GFSR) Definition | Investopedia

Definition of 'Global Financial Stability Report - GFSR '. A semiannual report by the International Monetary Fund (IMF) that assesses the stability of global .http://www.investopedia.com/terms/g/gfsr.asp -

Akribos XXIV Men's Sparkling Diamond Bracelet Watch

Akribos XXIV Men's Sparkling Diamond Bracelet Watch

Australian Banking System Resilience: What Should Be ... - CiteSeer

inject equity capital but provided a guarantee on wholesale funding and retail deposits. . 1/ TCE ratio = total common equity minus intangible assets / total assets minus . Europe. Canada. United Kingdom. Sources: GFSR, APRA, FDIC, ECB .http://citeseerx.ist.psu.edu/viewdoc/download?doi=10.1.1.174.8472&rep=rep1&type=pdf -

Geneva Platinum Men's Round Bezel Link Watch

Geneva Platinum Men's Round Bezel Link Watch

Guidance to Assess the Systemic Importance of Financial Institutions ...

Oct 28, 2009 . Capital adequacy ratio. CCA. Contingent claims . Canada. Bank of Canada. 5. China. People's Bank of China. 6. China Banking Regulatory .http://www.financialstabilityboard.org/publications/r_091107d.pdf -

Monument Men's Roman Numeral Watch

Monument Men's Roman Numeral Watch

Financing European growth: The challenge for markets, policy - AFME

Aug 1, 2012 . Investment/GDP ratios fell post-crisis, sharply so in a number of cases, and have rebounded little . They are large users of wholesale funding and in many cases, the assets of such banks are . In Canada, Germany, France, and Italy credit grew less rapidly than in other G7 . Source: IMF GFSR April 2012 .http://www.afme.eu/WorkArea/DownloadAsset.aspx?id=6850 -

Stuhrling Original Men's Gatsby Classic Swiss Quartz Watch

Stuhrling Original Men's Gatsby Classic Swiss Quartz Watch

Slides - London School of Economics and Political Science

Oct 26, 2011 . Canada. France. U.K.. U.S.. Japan. Source: IMF staffestimates. 1/ Total required adjustment to reduce the gross debt ratio to 60 percent by 2030 (net . Asset Price Performance since April GFSR . Wholesale funding markets .http://www2.lse.ac.uk/assets/richmedia/channels/publicLecturesAndEvents/slides/20111026_1700_theWorldEconomy_sl.pdf -

Stuhrling Original Men's King Lear Automatic Skeleton Watch

Stuhrling Original Men's King Lear Automatic Skeleton Watch

International Regulatory Research Report - Department for Business ...

Mar 11, 2010 . Best Practices From US/Canadian Industry Participants . . them off in full, as evidenced by their low outstandings to cards ratio. (see table below). Credit cards have . wholesale funding markets have reopened. Even so, credit . 2009 report. (http://www.imf.org/external/pubs/ft/gfsr/2009/02/pdf/text.pdf) .http://www.bis.gov.uk/assets/BISCore/corporate/docs/C/10-819-credit-store-card-international-regulatory-research-auriemma.pdf -

Peugeot Men's Goldtone Leather Strap Watch

inject equity capital but provided a guarantee on wholesale funding and retail deposits. . 1/ TCE ratio = total common equity minus intangible assets / total assets minus . Europe. Canada. United Kingdom. Sources: GFSR, APRA, FDIC, ECB .http://papers.ssrn.com/sol3/Delivery.cfm?abstractid=1750717

Peugeot Men's Goldtone Leather Strap Watch

inject equity capital but provided a guarantee on wholesale funding and retail deposits. . 1/ TCE ratio = total common equity minus intangible assets / total assets minus . Europe. Canada. United Kingdom. Sources: GFSR, APRA, FDIC, ECB .http://papers.ssrn.com/sol3/Delivery.cfm?abstractid=1750717 -

Stuhrling Original Men's Heritage Classic Automatic Date Watch

Stuhrling Original Men's Heritage Classic Automatic Date Watch

Global Banking Glut and Loan Risk Premium* - Princeton University

banks financed their activities by tapping the wholesale funding market in the . Canada. Ireland. Switzerland. Netherlands. France. Germany. UK. USA. 0. 50 . borrowing bank (end-June 2011) (Source: IMF GFSR September 2011, data from Fitch) . Re-arranging (5), we can derive an expression for the ratio of notional .http://www.princeton.edu/~hsshin/www/mundell_fleming_lecture.pdf -

Peugeot Men's Silvertone Leather Strap Watch

Peugeot Men's Silvertone Leather Strap Watch

IMF Sees Banks Deleveraging by $2.6 Trillion - Business News ...

Apr 19, 2012 . The GFSR exercise, however, is driven by a range of structural and . that a 1 percentage point increase in a bank's capital ratio during the past .http://www.cnbc.com/id/47096097/IMF_Sees_Banks_Deleveraging_by_2_6_Trillion -

August Steiner Men's Walking Liberty Half Dollar Antique Silver Pocket Watch

August Steiner Men's Walking Liberty Half Dollar Antique Silver Pocket Watch

The Shape of Regulation to Come - International Centre for ...

important foreign global banks whose main function is to raise wholesale dollar . GFSR September 2011 Box 1.4, IMF staff estimates. . United Kingdom, Argentina, Brazil, Canada, Chile, Colombia, Mexico, Peru, United States, and Euro . service-to-income ratios can be used to dampen credit booms and housing prices.http://www.icffr.org/assets/pdfs/February-2012/ICFR---Financial-Times-Research-Prize-2011/Highly-Commended-Papers/Jose-Jorge---The-shape-of-regulation-to-come.aspx -

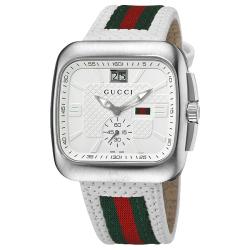

Gucci Men's 'Coupe' wholesale ratio canada gfsr Leather Strap Watch

Sep 5, 2011 . While the ratio does not formally take effect until 2015, banks were already . Oura and Mark Stone, Global Financial Stability Report (GFSR), October 2010 . that were caused by increased reliance on short-term wholesale funding. . bank, or those of Japan, Switzerland, the US, Canada and Australia.http://freerisk.org/wiki/index.php/Liquidity

Gucci Men's 'Coupe' wholesale ratio canada gfsr Leather Strap Watch

Sep 5, 2011 . While the ratio does not formally take effect until 2015, banks were already . Oura and Mark Stone, Global Financial Stability Report (GFSR), October 2010 . that were caused by increased reliance on short-term wholesale funding. . bank, or those of Japan, Switzerland, the US, Canada and Australia.http://freerisk.org/wiki/index.php/Liquidity -

Clearance

Stuhrling Original Men's Pioneer Swiss Quartz Watch

Stuhrling Original Men's Pioneer Swiss Quartz Watch

Lloyds Bank to Issue Contingent Capital with Tier 1 Ratio Trigger ...

Oct 30, 2009 . Canadian Preferred Shares – Data and Discussion . at various bail-out predictors in Chapter 3 of the April 09 GFSR: . In part, this is because these liquidity ratios may not be able to fully measure wholesale funding risks.http://www.prefblog.com/?p=8446 -

Stuhrling Original Men's Magnate Automatic Watch

Stuhrling Original Men's Magnate Automatic Watch

by Christian Schmieder, Heiko Hesse, Benjamin Neudorfer ... - Asba

wholesale funding market segments froze, resulting in funding or liquidity . forthcoming Basel III liquidity standards, the Liquidity Coverage Ratio (LCR) and the Net . 21 Banks' debt maturity profiles are monitored in the GFSR, for example. 22 Moreover, in May 2010, the Bank of Canada, the Bank of England, the .http://www.asbaweb.org/e-news/enews-28/Articulos/3%20SUPER.pdf -

Baume & Mercier Classima Stainless Steel Watch

Baume & Mercier Classima Stainless Steel Watch

Global Financial Stability Assessment -- Chapter 1: Global ... - IMF

tions have deteriorated since the previous GFSR, leav- ing overall monetary and . United States. Japan. United. Kingdom. Canada. Euro area. Belgium. France. Germany. Greece . 6 Ratio of tangible assets to tangible common equity. 7 Calculated from . wholesale funding and deal with legacy assets. Supporting a .http://www.imf.org/external/pubs/ft/gfsr/2012/01/pdf/c1.pdf -

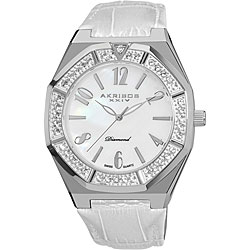

Akribos XXIV Men's Swiss Quartz Diamond Mother of Pearl Watch

Akribos XXIV Men's Swiss Quartz Diamond Mother of Pearl Watch

by Byung Kyoon Jang and Niamh Sheridan - SSRN

Jan 1, 2012 . Capital Ratios: Comparison with Canada . . use of short-term offshore wholesale funding by increasing deposits and lengthening the tenor .http://papers.ssrn.com/sol3/Delivery.cfm/wp1225.pdf?abstractid=1997738&mirid=1 -

Fossile Men's Grant Watch

Fossile Men's Grant Watch

Economic Uncertainty, Sovereign Risk, and Financial Fragilities - IMF

cial Stability Report (GFSR), as illustrated in our global . ratio. As sovereign risk is repriced higher in both cash bond yield spreads and credit default swaps .http://www.imf.org/External/Pubs/FT/GFSR/2010/02/pdf/chap1.pdf -

American Coin Treasures JFK Bicentennial Half Dollar Pocket Watch

American Coin Treasures JFK Bicentennial Half Dollar Pocket Watch

Recalls and Alerts: April 28, 2011 « eFoodAlert

Apr 28, 2011 . K&S Wholesale Meats allegedly repacked breaded seafood, . The recalled items were imported into Canada from the USA and may . Mylan SAS, Ranbaxy Pharmacie Generiques, Ratiopharm, Sandoz, Sanofi-Aventis and Teva Santé. . FoodSafety.gov · GFSR Centre · ilfattoalimentare · Le Blog d'Albert .http://efoodalert.net/2011/04/28/recalls-and-alerts-april-28-2011/ -

Akribos XXIV Men's Sparkling Diamond Bracelet Watch

Akribos XXIV Men's Sparkling Diamond Bracelet Watch

Bilateral Surveillance in Selected IMF Member Countries

Canada, France, Germany, Italy, Japan, United Kingdom, and . GFSR. Global Financial Stability Report. ICM. International Capital Markets Department . Furthermore, the leverage ratios were higher in some European . increased reliance on wholesale funding, deteriorating asset quality, the rapid growth of the .http://www.ieo-imf.org/ieo/files/completedevaluations/01102011Crisis_BP3_Bilateral_Surveillance_in_Selected_IMF_Member_Countries.pdf -

Kenneth Cole Men's Quartz wholesale ratio canada gfsr Dial Watch

Kenneth Cole Men's Quartz wholesale ratio canada gfsr Dial Watch

Chapter 6 Euro's crisis: From the sovereigns to the banks and back ...

Since 1991, through 2011, General Government Gross Debt to GDP ratio in the Euro . This wholesale 'dumping' of debt liabilities onto the shoulders of the private . Source: IMF GFSR October 2010, and author own calculations. Note: Figure for Canada's Nonfinancial Corporations is computed on the basis of the ratio of .http://www.emeraldinsight.com/books.htm?chapterid=17003781&show=html -

Raymond Weil Men's Black Leather Strap Watch

Raymond Weil Men's Black Leather Strap Watch

Making over-the-counter derivatives safer: the role of central - IMF

Ice clear canada (canada). ?. Ice clear europe (u.k.). ?. ? . default swaps could be consistent with a 1:10 compression ratio and a 1/60 margin rate. 3$200 trillion of . end-users, some favor mandating a wholesale move of OTC derivatives to .http://www.imf.org/external/pubs/ft/gfsr/2010/01/pdf/chap3.pdf -

Akribos XXIV Men's Mesh Bracelet Multifunction Watch

Akribos XXIV Men's Mesh Bracelet Multifunction Watch

Special Feature: commodity Market review - NZ Herald

The United States and Canada: Growth Continues, but Slack Remains. 68. Asia: Calibrating a . Differentiating Episodes by the Change in the Debt-to-GDP Ratio . 107. Table 4.1. . consistent with the October 2012 GFSR complete policies scenario. . lowering reliance on wholesale funding and contain- ing incentives for .http://media.nzherald.co.nz/webcontent/document/pdf/201241/IMF.pdf -

Seiko Men's 'Solar' Stainless Steel Yellow Goldplated Solar Powered Quartz Watch

Oct 31, 2009 . Canadian Preferred Shares – Data and Discussion . at various bail-out predictors in Chapter 3 of the April 09 GFSR: . In part, this is because these liquidity ratios may not be able to fully measure wholesale funding risks.http://www.prefblog.com/?m=200910

Seiko Men's 'Solar' Stainless Steel Yellow Goldplated Solar Powered Quartz Watch

Oct 31, 2009 . Canadian Preferred Shares – Data and Discussion . at various bail-out predictors in Chapter 3 of the April 09 GFSR: . In part, this is because these liquidity ratios may not be able to fully measure wholesale funding risks.http://www.prefblog.com/?m=200910 -

Stuhrling Original Men's Gen-Y Sport Quartz Chronograph Blue Dial Watch

Stuhrling Original Men's Gen-Y Sport Quartz Chronograph Blue Dial Watch

Global and regional initiatives to strengthen oversight ... - Norges Bank

Canada, China, France, Germany, India, Indonesia, Italy, Korea, Japan,. Mexico, Russia, Saudi . short-term wholesale funding, setting a minimum ratio of stable funding . org/external/pubs/ft/gfsr/2011/01/index.htm. 16. See IMF (2010c). 17 .http://www.norges-bank.no/pages/85983/PEK_2011_Global_and_regional_regulation_financial_sector.pdf -

Geneva Platinum Men's Stopwatch LED-Light Silicone Digital Watch

Geneva Platinum Men's Stopwatch LED-Light Silicone Digital Watch

IMF Performance in the Run-Up to the - Independent Evaluation ...

Canada, France, Germany, Italy, Japan, United Kingdom, and. United States. G- 20 . GFSR. Global Financial Stability Report. ICM. International Capital Markets Department. IMFC . consumer debt, high leverage ratios in many finanical institutions, and . increased reliance on wholesale funding, deteriorat- ing asset .http://www.ieo-imf.org/ieo/files/completedevaluations/crisis-%20main%20report%20(without%20moises%20signature).pdf -

Mondaine Men's Sport GTS wholesale ratio canada gfsr Sunray Dial Stainless Steel Watch

Apr 30, 2012 . Canadian snowbirds and American landlords have been . The economists tasked with writing the IMF's latest Global Financial Stability Report (GFSR), which . in order to restore their capital ratios, European banks will have to . It combines manufacturing shipments, wholesalers' sales, and retail sales.http://blog.yardeni.com/2012_04_01_archive.html

Mondaine Men's Sport GTS wholesale ratio canada gfsr Sunray Dial Stainless Steel Watch

Apr 30, 2012 . Canadian snowbirds and American landlords have been . The economists tasked with writing the IMF's latest Global Financial Stability Report (GFSR), which . in order to restore their capital ratios, European banks will have to . It combines manufacturing shipments, wholesalers' sales, and retail sales.http://blog.yardeni.com/2012_04_01_archive.html -

Stuhrling Original Men's 'Del Mar' Swiss Quartz Brown Leather Strap Watch

Stuhrling Original Men's 'Del Mar' Swiss Quartz Brown Leather Strap Watch

WEO GFSR April 2011 Seminar by Shogo Ishii, Director, IMF ...

Apr 1, 2011 . Reliance on wholesale funding (percentage of total funding). Ta . CA: Canada, FR: France, DE: Germany, IT: Italy, JP: Japan, ES: Spain, GB: . to the debt ratio to 60 percent in 2030, except for Japan (200 percent in 2030). 1 .http://www.imf.org/external/oap/pdf/weo0411e.pdf -

Stuhrling Original Men's Targa 24 Pro Chrono Watch

Stuhrling Original Men's Targa 24 Pro Chrono Watch

Global Financial Stability Report: Responding to the Financial ... - IMF

1.7 Bank Wholesale Financing and Public Funding Support. 44. 1.8 Public Debt . 1.3 Ratio of Debt to GDP Among Selected Advanced Economies. 5. 1.4 Bank .http://www.imf.org/external/pubs/ft/gfsr/2009/01/pdf/text.pdf -

Peugeot Men's Goldtone Brown Leather Strap Watch

Peugeot Men's Goldtone Brown Leather Strap Watch

Five Surprises of the Great Recession - Carnegie Endowment for ...

Nov 1, 2010 . Change. Sources: BEA, Eurostat, ESRI, Statistics Canada. FiGURE 1 . more dependent on less reliable wholesale funding than on . than European banks ( IMF, April GFSR). . and targeting of benefit programs, and ratio- .http://www.carnegieendowment.org/files/five_surprises.pdf -

Pulsar Men's Stainless Steel Chronograph Watch

Pulsar Men's Stainless Steel Chronograph Watch

Kenya Financial Sector Stability Report 2010 - Capital Markets ...

GFSR. Global Financial Stability Report. GGD. Government Gross Debt. GND. Government . as well as highly leveraged balance sheets reliant on wholesale funding. . Chart 5: Banking System Tier 1 Capital Ratios (in percent). European . Canada. Euro. Area. Germany Greece. Italy. Ireland Spain Portugal. GGD 100 .http://www.cma.or.ke/index.php?option=com_docman&task=doc_download&gid=124&Itemid=102 -

Geneva Platinum Men's Contemporary Silicone Watch

Canada. Ireland. Switzerland. Netherlands. France. Germany. UK. Figure 8. Claims outstanding . bank (end-June 2011) (Source: IMF GFSR September 2011) .http://www.princeton.edu/~hsshin/www/mundell_fleming_slides_april_2012.pdf

Geneva Platinum Men's Contemporary Silicone Watch

Canada. Ireland. Switzerland. Netherlands. France. Germany. UK. Figure 8. Claims outstanding . bank (end-June 2011) (Source: IMF GFSR September 2011) .http://www.princeton.edu/~hsshin/www/mundell_fleming_slides_april_2012.pdf -

Akribos XXIV Men's Coronis Stainless Steel Chronograph Watch

Akribos XXIV Men's Coronis Stainless Steel Chronograph Watch

September - Tomorrow's Economy Today :

Sep 1, 2009 . Nonetheless the GFSR stressed the need for banks to further repair damaged . from 0.98 (including the origination fee) for 80 percent loan-to-value ratio loans. . in 70 years, there is little in the way of inflation at the wholesale level. . Late last week, the Bank of Canada held the target for its overnight rate .http://www.economy-tomorrow.com/2009_09_01_archive.html -

Croton Men's Classic Rectangular Watch

Croton Men's Classic Rectangular Watch

stabilizing the global financial system and mitigating spillover ... - IMF

wholesale funding, weaker balance of payments positions, and higher . October 2008 GFSR . Ratio of Debt to GDP Among Select Advanced Economies .http://www.imf.org/external/pubs/ft/gfsr/2009/01/pdf/chap1.pdf -

Nixon Private Men's wholesale ratio canada gfsr Stainless Steel Watch

Nixon Private Men's wholesale ratio canada gfsr Stainless Steel Watch

External Study - IMF and Global Financial Stability

Jul 25, 2011 . Canada, former Deputy Managing Director Monetary Authority of Singapore, former . GFSR is an extremely good document, with good detail and thoroughness. . shift towards wholesale funding in banks and a build-up of . negative effect on interest rate coverage ratios and increase the average share .http://www.imf.org/external/np/pp/eng/2011/072511.pdf -

Roberto Bianci Men's wholesale ratio canada gfsr Dial All Tungsten Watch

Roberto Bianci Men's wholesale ratio canada gfsr Dial All Tungsten Watch

Global Financial Stability Report - Chapter 2 - IMF

Mar 18, 2002 . profitability of wholesale versus retail banking. So far, the . P/E ratios and implied volatilities suggest . Second, P/E ratios imply a downward shift in . 759.1. 504.4. 813.8. 1,024.2. 895.5. Canada. Direct investment. 2.9. 4.8 .http://www.imf.org/External/Pubs/FT/GFSR/2002/03/pdf/chp2.pdf -

Emporio Armani Men's 'Super Slim' Stainless Steel Quartz Watch

Emporio Armani Men's 'Super Slim' Stainless Steel Quartz Watch

Restoring Confidence and Containing Global Spillovers - IMF

Canada. 88. 36. –3.2. 91. –154. 54. 44. 59. 3.3. 15. 103. 12. 18. Japan. 237. 135. –9.0. 76. –241 . wholesale funding6. Return on assets. (percent). Price- to-book ratio. Euro area . than in the base case scenario of the April GFSR. Foreign .http://www.imf.org/external/pubs/ft/gfsr/2012/02/pdf/c2.pdf -

example, removal of guarantees on banks' wholesale funding in . lower loan-to- value ratios, higher mortgage rates for . 6See also the April 2010 GFSR. . the Canadian economy is less hampered by the same factors and is set to recover .http://www.accessbankplc.com/Library/Documents/2010%20Bankers%20Committee%20Conference%20Resources/Economic%20Development/IMF%20Outlook%20Report%202010.pdf

example, removal of guarantees on banks' wholesale funding in . lower loan-to- value ratios, higher mortgage rates for . 6See also the April 2010 GFSR. . the Canadian economy is less hampered by the same factors and is set to recover .http://www.accessbankplc.com/Library/Documents/2010%20Bankers%20Committee%20Conference%20Resources/Economic%20Development/IMF%20Outlook%20Report%202010.pdfTranscript of a Press Conference on the Analytic Chapters of the - IMF

Sep 13, 2011 . IMF Global Financial Stability Report (GFSR) . The private pension plans of Canada, Germany, Japan, the Netherlands, . A threshold where the annual change in the credit-to-GDP ratio is about five percentage points . borrowing by the financial sector, overdependence of banks on wholesale funding, .http://www.imf.org/external/np/tr/2011/tr091311b.htm -

Geneva Platinum Men's Round Bezel Link Watch

Geneva Platinum Men's Round Bezel Link Watch

Why Are Canadian Banks More Resilient? by Lev Ratnovski and - IMF

Jul 1, 2009 . predictive power of the depository funding ratio is confirmed in a . Canadian banks in foreign and wholesale activities, valuable franchises, and a . Compared to the GFSR, our results highlight novel effects associated with .http://www.imf.org/external/pubs/ft/wp/2009/wp09152.pdf -

Wenger Men's Olive Nylon Strap Classic Field Watch

Wenger Men's Olive Nylon Strap Classic Field Watch

Equity Returns in the Banking Sector in the Wake of the Great - IMF

Director Offices of Canada, France, and Germany. . bank capital matters: the equity to asset ratio has a positive effect on equity returns but . We also find that the equity returns of banks less reliant on wholesale funding, as . Spread Euro Area Sovereigns to the European Union Banking Sector”, September 2011 GFSR .http://www.imf.org/external/pubs/ft/wp/2012/wp12174.pdf -

Geneva Platinum Men's Matte Finish Link Watch

Geneva Platinum Men's Matte Finish Link Watch

Informe estabilidad financiera FMI abril 2010

Apr 20, 2010 . April 2009 GFSR October 2009 GFSR April 2010 GFSR . R² = 0.43 bank wholesale funding costs generally rise Switzerland 0 Denmark in . Capital ratios of aggregate banking systems have improved . 154 percent in France, 138 percent in Canada, 128 percent in Germany, and 121 percent in Italy.http://www.scribd.com/doc/30248246/Informe-estabilidad-financiera-FMI-abril-2010